If the house always wins, build a casino

“Should we be concerned about a ‘Venture Deep State’? A ‘FOMO Industrial Complex’? Limbic Capitalism?”

Joe Milam, Founder of AngelSpan

A previous article discussed why venture capital has such a myopic focus on backward-looking metrics connected to ARR.

The summary is that people struggle with uncertainty, and there are two ways to cope: embrace it scientifically, or build a structure that lets people gamble on it.

Enter “casino culture”.

“Sports betting, shitcoins, meme stocks, vibe coding 100m in six hours, etc, are all expressions of the same deep cultural rot. If youth don’t believe there’s legitimate ways to get rich through work, all of culture will become a rotten sports book for the soul.”

Will Manidis

If you want to bet on startups, ARR provides a convenient metric to compress complexity and uncertainty into one dimension, reducing venture capital to a simple horse-race.

Investors make bets on momentum categories, riding the wave of revenue driven by large injections of capital, and hope they can raise another fund or exit before the music stops.

Combine that with the compounding influence of the “power law” meme, and the incentives to concentrate capital, you’ve got a real lottery on your hands.

Like an actual lottery, the net cash return is negative.

“It’s very difficult to invest money well, and I think it’s all but impossible to do time after time after time in venture capital. Some of the deals get so hot, and you have to decide so quickly, that you’re all just sort of gambling.”

Charlie Munger, Vice Chairman of Berkshire Hathaway

The beneficiaries of this limbic shift are the agglomerators, who play the role of “the house”; appearing to participate in the risk while harvesting beta from the associated activity.

For other investors, there are incentives to play:

Primarily, it gives GPs a simpler story to sell to LPs, inspiring greater confidence. They can enthusiastically shill consensus ideas and relationship-based access — which is exactly what many LPs want to hear, despite the poor returns.

Secondly, it diversifies away accountability. As more investors jump on-board the momentum train, individual career risk is exchanged for greater systematic fragility. When the market collapses, they can survive on relationships.

By turning venture capital into a game of chance, abusing the principal-agent problem, their job is greatly simplified: It’s the blue pill of steak dinners and congeniality, not the red pill of grinding hackathons and building portfolios.

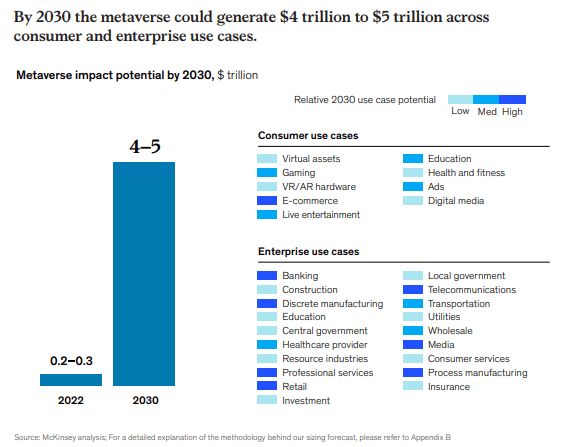

Unfortunately, by abstracting the performance if investments from the underlying asset value with crude proxy metrics, the concept of “innovation” is mostly a mirage. It may be difficult to perceive at the time, when the traction feels real, but few truly important companies emerge from this environment.

“Consistently surprised by general lack of world changing ambition with seed stage cos and “early stage” VCs. Era of incrementalism still prevalent.”

Jimmy Yun, Investor at 8VC

Limbic capitalism produces what Byrne Hobart and Tobias Huber have described as “virtual innovation” in Boom: Bubbles and the End of Stagnation.

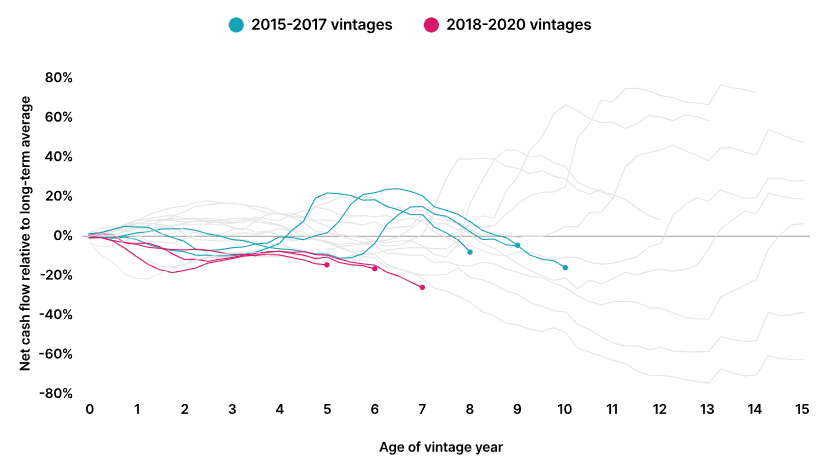

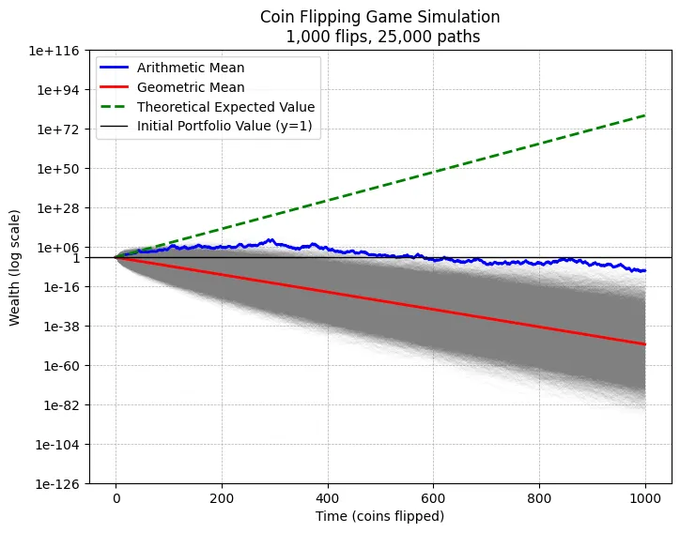

Essentially, a category emerges as the focal point for venture allocation, concentrating capital, and participants begin flipping coins under the long-standing premise that the upside of winners is always much greater than the downside of losses.

How could they possibly lose?

In the end, everyone eventually loses — except the house.

It turns out that the very behavior they engage in is destroying returns, and the only winner is the person collecting fees to manage the bank.

“Risk too much hunting jackpots and the volatility will turn positive expected value into a straight line to zero. In the world of compounded returns, the dose makes the poison.”

The Jackpot Paradox

(top image: “The Romans of Decadence , by Thomas Couture)

Leave a Reply