In the last post, I talked about the hunt for liquidity in VC and the role that transparency has in building a healthy secondary market. To take that further, we should look more carefully at the structure of venture capital, the direction the asset class is moving, and lay out a direction which can address… Continue reading Why venture capital should embrace divergence

Tag: Vc

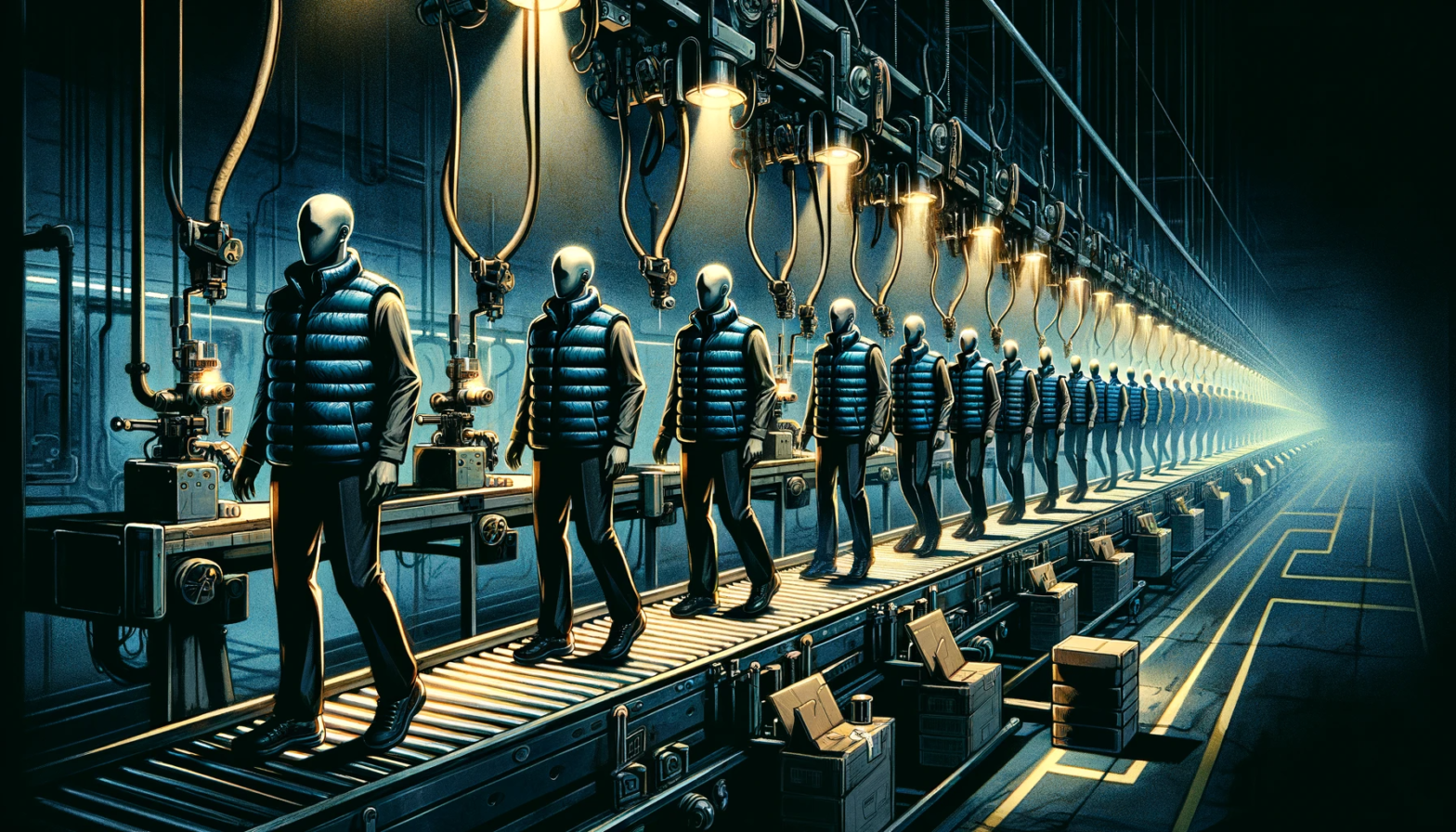

Deus ex machina

for VC, the success of AI is existential Imagine entering VC in 2020, full of enthusiasm about a wave of technology that felt unstoppable. Your peers are impressed; it’s a prestigious industry that is perceived as commanding a lot of power (and capital). You have to put aside your personal thesis in favour of the… Continue reading Deus ex machina

Adverse selection and venture capital

There’s a weird phenomenon among VCs where the less successful they are, the more evil they become to founders to squeeze more money out of their best startups out of necessity which then becomes a vicious cycle of adverse selection. Garry Tan, President & CEO of Y Combinator Including the above, criticism of venture capital… Continue reading Adverse selection and venture capital

“Why don’t VCs set marks with 409a valautions?”

This is a question I saw on Reddit’s often-comical /r/venturecapital, which I thought was interesting enough to write out a decent response to. It hits at the root of a few major problems in the asset class which are always worth addressing. A 409A valuation, named after Section 409A of the United States Internal Revenue… Continue reading “Why don’t VCs set marks with 409a valautions?”

It’s all about identifying outliers

What startup investors can learn from sports betting Early stage investing is a complex and relatively new practice, which makes it fertile ground for analogies which can help explain the more abstract concepts to both newcomers and veterans alike. In this particular case, grappling with the intrinsic value of pre-revenue startups, there’s an interesting parallel… Continue reading It’s all about identifying outliers

Startups are the clients of Venture Capital

As a founder learning the ropes of venture capital, you might see VCs as asset managers, with LPs as their customers and your equity as the asset being managed. This is heavily implied by the chain of responsibility: you are required to report your progress to your VC investors who want to see milestones crossed… Continue reading Startups are the clients of Venture Capital

LPs should encourage VC evolution

In a previous article I wrote about the threat of consensus in venture capital. A few days later, Eric Tarczynski shared a fascinating thread about the journey with Contrary, his VC firm. He addressed this point about consensus with admirable candour, summarised here in two points: It’s unusual to get such an unvarnished look at… Continue reading LPs should encourage VC evolution

Why venture capital should be consensus-averse

In The General Theory of Employment, Interest and Money, Keynes wrote about investment through the metaphor of a newspaper contest to select the six best looking people from a group of photos, with the prize being awarded to the contestant whose choice most closely corresponded to the average of all contestants. Keynes’ point was that,… Continue reading Why venture capital should be consensus-averse