Innovation is chaos. Finance is order.

All attempts to finance innovation are torn between these two forces.

allocate, scale, concentrate / experiment, adapt, diversify

You can be a $15B venture bank, deploying across a set of branded thematic funds led by pod-shop style managers.

Or, you can be a $5M solo GP, investing in “weird stuff, early“.

The health of technology and venture capital depends on the balance between the two ends of this spectrum.

Fragility

While many systems are entropic (tend towards chaos), financial systems are typically negentropic (tend towards order). There is increasing systematisation and regulation, aimed at developing reliability in the associated activity.

“Negentropy is reverse entropy. It means things becoming more in order. Here ‘order’ means organisation, structure and function: the opposite of randomness or chaos. One example of negentropy is a star system such as the Solar System. Another example is life.”

Wikipedia

In a venture capital context, this is reflected in the emergence of Tiger-style investement strategies, incumbent funds capturing a growing portion of LP capital, and the extreme attention on a few late-stage “hyperscalers”.

This often implies a loss of alpha, as fund strategies converge on consensus and returns converge on benchmarks. Not only do investors lose their edge, they also become fragile; susceptible to systemic shocks.

This direction favours larger firms that represent “institutional stewards” of capital, with more organisational structure and reputational capital to attract larger LPs.

Antifragility

In an entropic environment, resources aren’t allocated by design — they are spread broadly in a manner that increases the surface area of utilisation and opportunity. There is relatively little danger from overcapitalisation or overconcentration.

In a venture capital context, this is reflected in how fund of fund platforms, accelerators and emerging managers distribute capital across markets, industries and geographies.

“Entropic distribution of resources is critical for the health and resiliency of any ‘system’, including entrepreneurship and venture capital.”

Joe Milam, Founder of AngelSpan

Entropic distribution increases the likelihood that those who need capital will get it, at a cost to those who want a lot of capital — who may not. Capital flows out to a wider variety of people and ideas, without feeling the gravity of the “obvious”.

This direction favours smaller managers who represent greater risk, managed through greater diversification (smaller individual funds), and inreased alpha via their more extreme divergence from benchmark returns.

Walking the Line

There is a case for negentropy in helping to assemble large pools of risk capital to scale important projects in later stages. Whether that should be marketed as venture capital is another question.

It becomes problematic when the negentropic tendency of financial interests creates large pools of capital seeking excuses for deployment. This is a primary driver of unproductive bubbles.

Indeed, finding new opportunities to invest capital is the strength of entropic distribution, through managers that are less incumbered by structure and can more readily embrace the chaos of the unknown.

Today, it seems clear that the industry has heavily biased toward negentropy, first as a reaction to surging capital inflows, and latterly as a reaction to collapsing liquidity (created by that negentropy).

This must be corrected, not only because it’s an unjust outcome for small managers, but because their entropic distribution underpins the entire downstream capital environment.

(Credit to Jordan Nel’s fantastic article about antifragile venture capital, Joe Milam’s message about entropic distribution, and the excellent conversation between Peter Walker and Arian Ghashghai.)

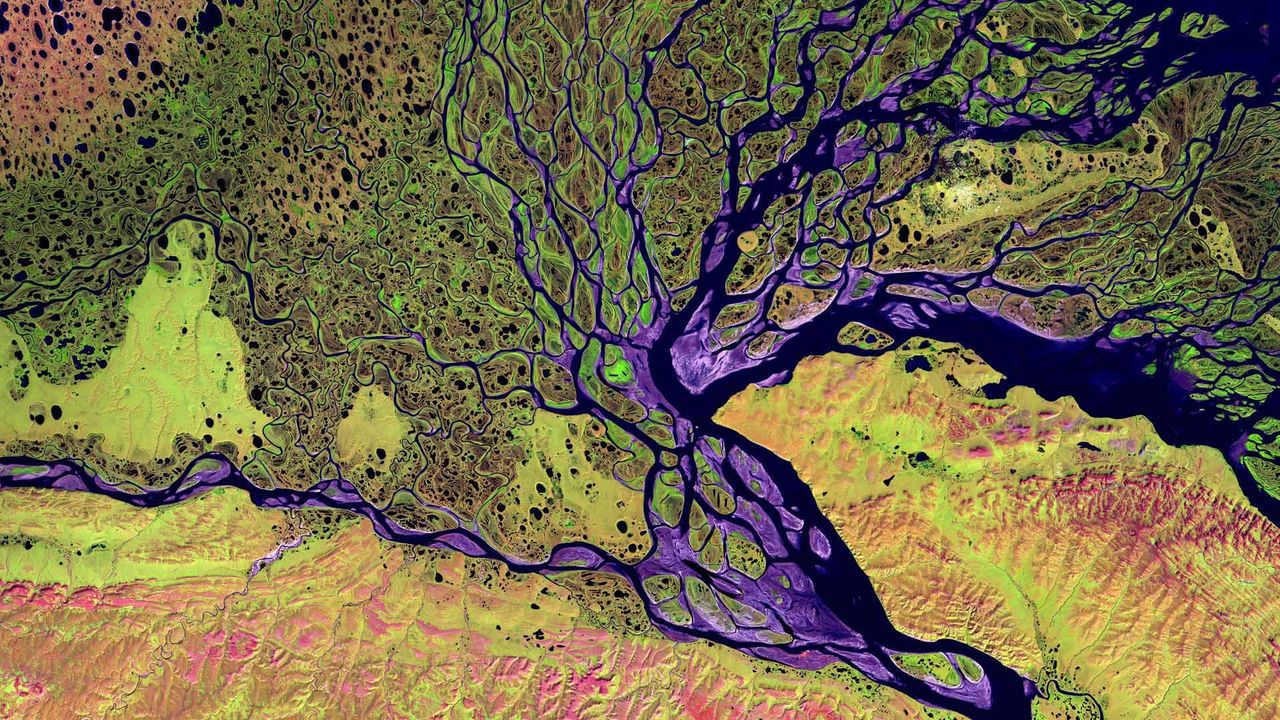

(top image: Lena River Delta – NASA)

Leave a Reply