The influence of productivity shocks, peer effects and cost of capital on AI IPO ambitions, and what happens next.

While leaders at xAI, Anthropic and Mistral have been silent on their plans to go public, OpenAI is starting to open up.

Back in May it was reported that negotiations with Microsoft included provisions that allowed OpenAI to file for an IPO. The transition to a Public Benefit Corporation (PBC) the following month made that technically possible. Both Altman (CEO) and Friar (CFO) have made statements alluding to the process since. Indeed, simply the fact that Friar is being put in front of the media more often as a leadership figure is a significant signal.

OpenAI’s most recent release may underline this direction. By prioritising model economics (focusing on the “router” capability) rather than model performance, the reception to GPT-5 was poor. In reality, this may reflect a shift in posture toward public market metrics, and their willingness to take the PR hit.

The prompt router also lays the groundwork for OpenAI to provide selective access to more expensive models. The next generation of LLMs will be powered by NVIDIA’s Blackwell chips, offering ~30x faster real-time inference. The chips are rolling out at the moment, with an impact on model releases expected next year.

Assuming these models will be a major step-up in competence, this could be the tipping point for a wave of AI IPOs in 2026.

Factor 1: Productivity Shocks

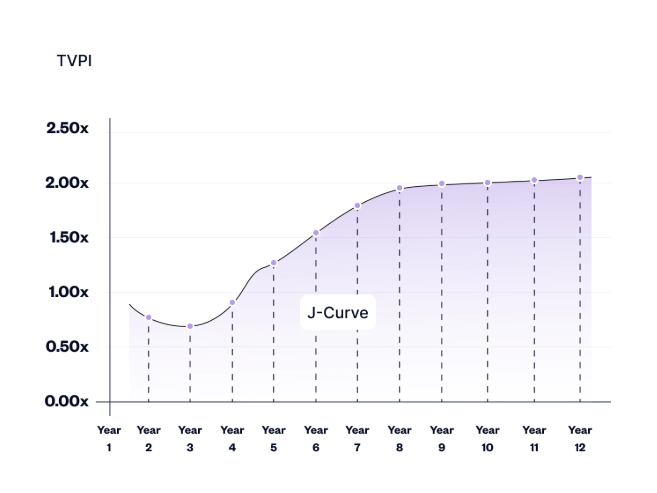

In our model, two firms, with differing productivity levels, compete in an industry with a significant probability of a positive productivity shock. Going public, though costly, not only allows a firm to raise external capital cheaply, but also enables it to grab market share from its private competitors.

IPO Waves, Product Market Competition, And the Going Public Decision: Theory and Evidence

When an industry experiences (or anticipates) a significant positive productivity shock (an inflection point in their ability to generate value), this may trigger an “IPO wave”.

Essentially, if there’s a significant step-up across the industry then there’s a real incentive to be the first (or at least be early) to tap public markets for capital to drive market-share expansion.

LLMs have continued to improve over the last few years, with a number of hyped releases and growing experimentation amongst enterprise users, but there has yet to be a truly significant “productivity shock” moment.

Factor 2: Peer Effects

We find that observing a peer go public within the previous 12 months raises the propensity to undertake an IPO from a baseline rate of 0.31 percent per quarter to 0.44 percent per quarter, amounting to a 40 percent increase in IPO propensity. This result is robust to accounting for hot market effects and other common shocks that may affect competing firms’ IPO decisions.

IPO Peer Effects

The first to market has an advantage in that they may capture the demand for that industry amongst public market investors. They also bear all of the cost and the risk of blazing that trail, primarily that they might have greatly overestimated demand.

There is some benefit to being a “fast follower” in these circumstances, which is often what triggers the “IPO wave” dynamic seen in the culmination of tech cycles. However, the later you are in that wave, the less of the benefit you capture.

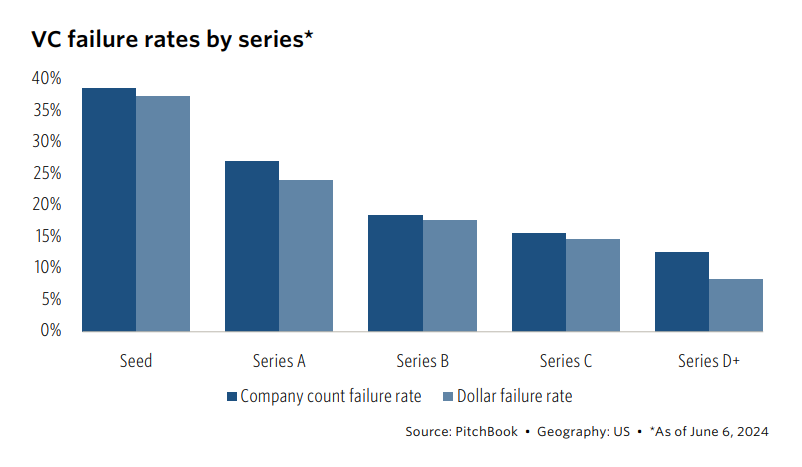

These periods, often characterised as “IPO windows” have been referred to in literature as “windows of misopportunity” for investors due to the increased failure rate. However, it’s also true that the few survivors tend to appear more innovative (in patent quality and quantity) than IPOs issued in other periods.

Overall, this chapter tend to conclude that “windows of opportunity” provides real opportunity to the most inventive private firms and allow them to raise public capitals to further their innovations.

Essays On Ipo Cycles And Windows Of Opportunity

Factor 3: Cost of Capital

We find that less profitable companies with higher investment needs are more likely to IPO. After going public, these firms increase their investments in both tangible and intangible assets relative to comparable firms that remain private. Importantly, they finance this increased investment not just through equity but also by raising more debt capital and expanding the number of banks they borrow from, suggesting the IPO facilitates their overall ability to raise funds.

Access to Capital and the IPO Decision: An Analysis of US Private Firms

There’s a common perception that going public is for mature companies who are past the period of aggressive growth, looking for more stable access to capital. This does not appear to be true.

In fact, companies that IPO are often doing so in order to increase their investment in growth, including intangible assets including R&D spend. This is particularly true in heavily competitive markets and capital-intensive businesses.

This has obvious relevance to LLM providers, who check a lot of these boxes. Certainly, in the phase of investing in infrastructure to support scale, lowering the cost of capital is a major priority.

Factor 4: Beyond Hedging

Similar to going public, hedging mitigates the effect of risk on a firm’s product market strategy, and, thus, results in greater product market aggressiveness. Therefore, in the presence of product market competition, hedging has a strategic benefit similar to that of an IPO. Importantly, we show that the availability of hedging reduces, but does not eliminate, the incentives to go public.

Strategic IPOs and Product Market Competition

Not necessarily a reason why LMM providers may look to IPO, but rather why they haven’t until now: “Hedging” in this context effectively reflects the relationships that many model providers have with large public companies like Microsoft, Amazon or Apple.

Rather than going public themselves, they can rely on these partnerships to fund investment and distribute risk, offering some of the benefits of going public without any of the costs.

However, the example of OpenAI’s relationship with Microsoft illustrates that it’s possible to outgrow these arrangements.

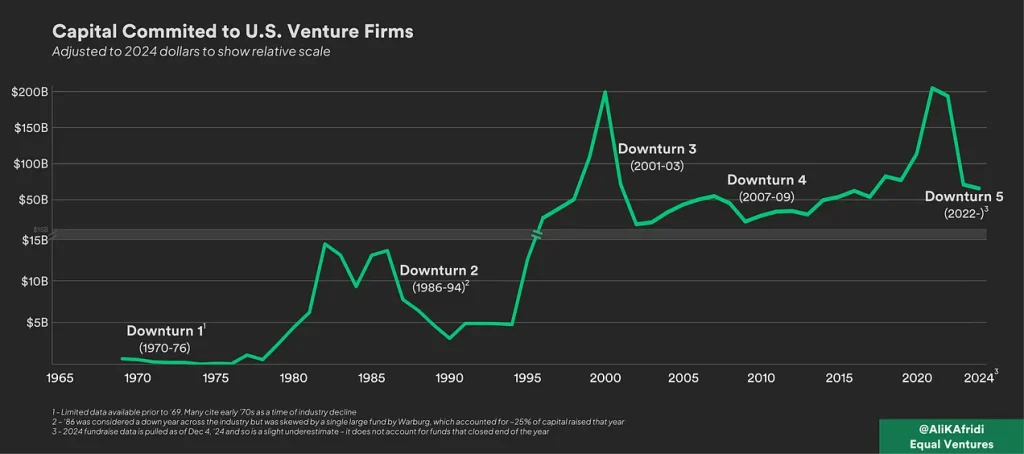

IPO Windows

Generally speaking, “IPO windows” are a mirage chased by liquidity-starved venture capitalists. A truly great company, like Figma, can IPO more-or-less whenever it wants to.

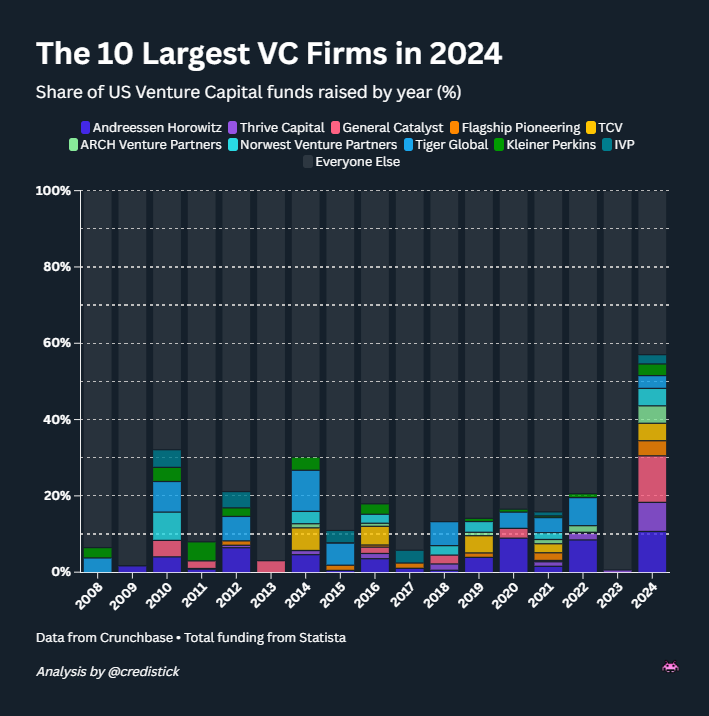

However, that dynamic changes when you have a group of peer-companies in a fiercely competitive (and capital intensive) industry. At that point, it is likely that there will be some strategic clustering of IPO ambitions.

A true “IPO window”, 1999/2000 or 2021, involves ~1,000 companies listing in the space of about six months. Diligence collapses, the quality of companies goes in the toilet, and public markets are torched for years afterwards. Sarbanes-Oxley killed this behavior in 2002, and it didn’t appear again until the low-interest-rate pandemic briefly drove public markets insane in 2021.

Why Wait

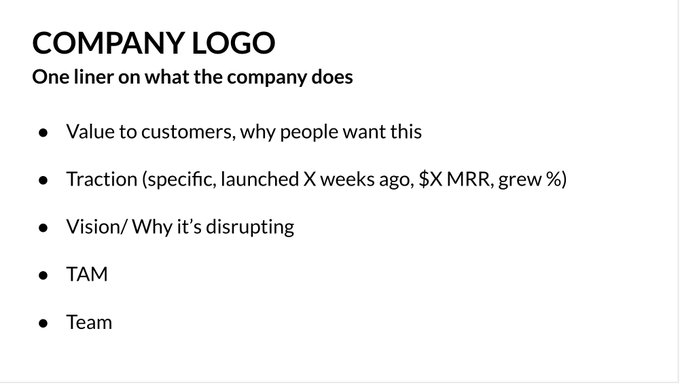

Assume that OpenAI is likely to be the first out. As today’s AI leader, with the widest consumer adoption and biggest brand, it seems the best positioned.1

What are they waiting for?

Primarily, they’ll be waiting to see if Blackwell unlocks the kind of productivity shock they are looking for. To clear their recent $500B valuation they’ll need to go public with undeniable momentum and a great story to tell new investors about future potential.

Secondly, going public is just a huge amount of work. Both in a technical sense, preparing the company’s books for intense scrutiny, and in a brand and PR sense. Prospective investors may need educating about the product, or the image of leadership may need some rehabilitation.2

IPOs are remarkably intense, and represent the most thorough inspection that a company will endure in its lifetime. This is why companies and their board of directors agonize over whether or not they are “ready” to go public. Auditors, bankers, three different sets of lawyers, and let us not forget the S.E.C., spend months and months making sure that every single number is correct, important risks are identified, the accounting is all buttoned up, and the proper controls are in place.

Investors Beware: Today’s $100M+ Late-stage Private Rounds Are Very Different from an IPO

Where Bubbles Emerge

There has been endless talk of a bubble of AI investment, and certainly there seems to be a disconnect between price and value.

This is true in private markets, reflected in transaction data, and in public markets, reflected by the delta between the MAG7 (all somewhat AI-connected) and the other 497 companies in the S&P.

However, the truth is that bubbles only really happen in public markets. They require liquidity, enabling the wild sentiment-driven swings in price that characterise a bubble.

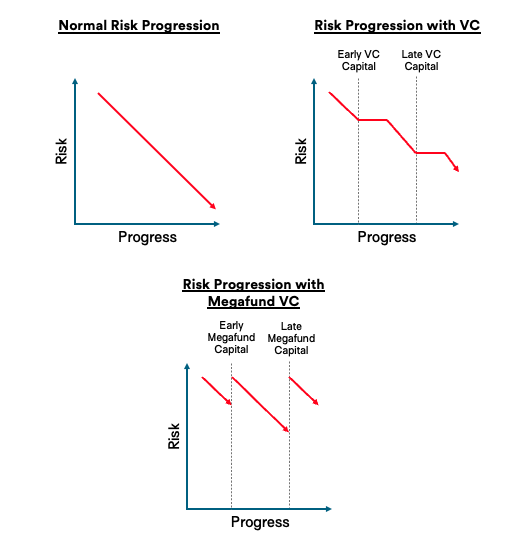

In illiquid markets, like venture capital, you have what William Janeway called “speculative episodes”, which may be derived from a bubble playing out in public markets (via comps) but do not behave in the manner of a bubble.

It’s almost as if wherever there is a liquid trading secondary market in assets, there you will find a bubble.

The Upside of Wasteful Speculative Bubbles and the Downside of Efficiency

Indeed, the concept of bubbles has been used in VC to disguise what is better described as simple greed and myopia. Investors behaving like traders — “riding the momentum train, and being ridden over by it, when it turns” — to quote Damodaran.

It’s illogical to describe what is happening today as a bubble if all of the current participants (including Altman himself) acknowledge that it looks like a bubble. A key feature of speculative bubbles is surely that the participants do not realise it’s a bubble? A more honest characterisation is simply that VCs are choosing to gamble on AI because their LPs believe they should.

This all changes when AI companies hit public markets, and the pool of investors (and capital) grows dramatically.

Consider the environment: post productivity shock, with an IPO wave led by the largest model providers but cascading into related industries and any company tha can crest the narrative.

This is precisely, and clasically, when we’d see a bubble emerge; in the volatile public markets, rather than the sluggish and opaque private markets.3

Until then, call it what it is: degenerate trading behavior.

(top image: Allegory on Tulipmania by Jan Brueghel the Younger)

- Arguably, xAI is the second in-line. [↩]

- As a minor footnote here, I believe Altman’s recent comments about AI as a bubble, his uncertainty at leading a public company, and an AI CEO in 3 years, are all deliberate narrative prompts. [↩]

- This also fits neatly with Howard Mark’s comments about the markets feeling ‘expensive’, and the potential for a major correction in the not-so-distant future. [↩]