In the last post, I talked about the hunt for liquidity in VC and the role that transparency has in building a healthy secondary market.

To take that further, we should look more carefully at the structure of venture capital, the direction the asset class is moving, and lay out a direction which can address the question of stronger secondaries and access to liquidity.

Venture capital spent the last decade pulling itself in two. The vast amount of capital resulted in the expansion of early investing while also keeping companies private for much longer. The role of a GP is now more specialised, with a greater focus either on the qualitative metrics at early stage, or the quantaitive metrics at later stage.

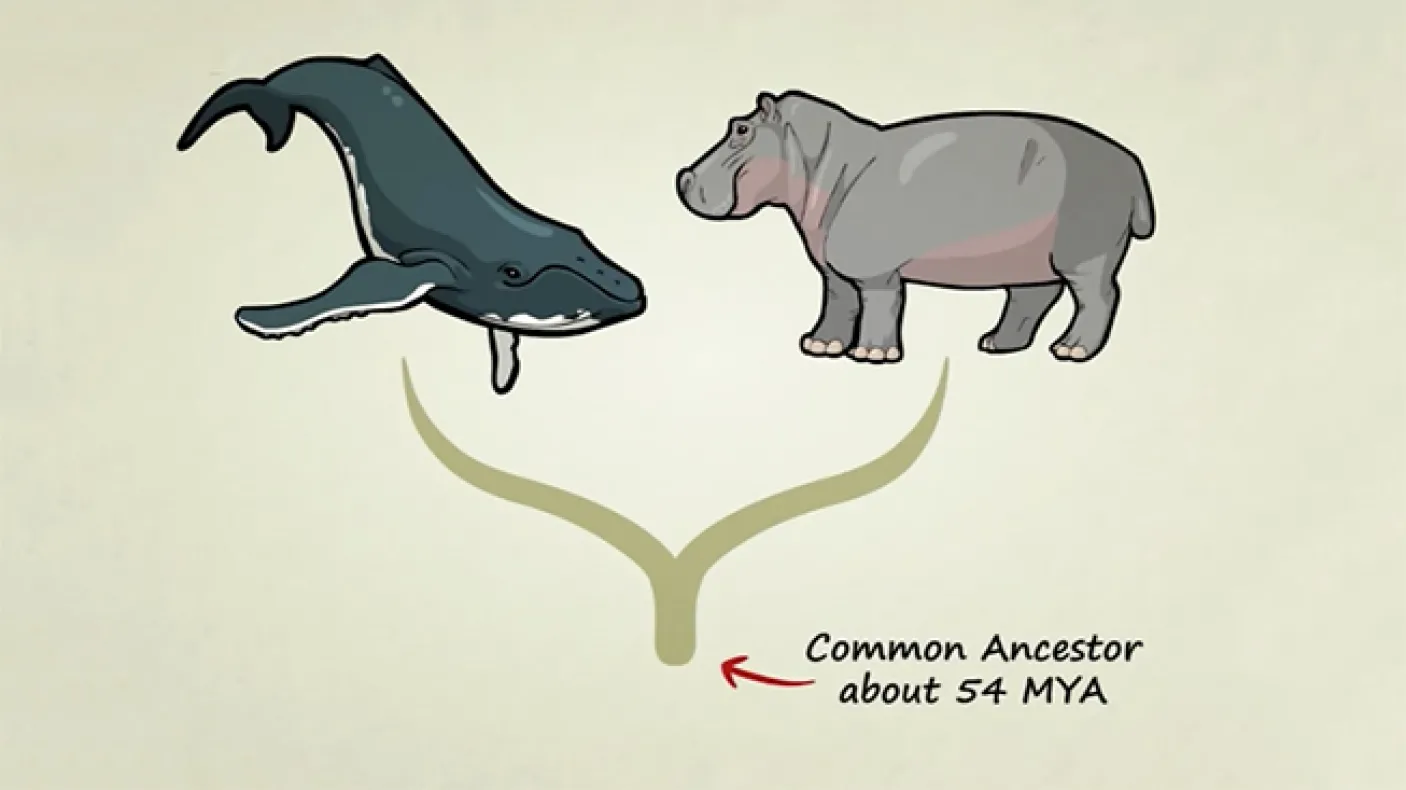

This divergence is new enough that it still causes significant confusion; it’s easy to find people talking at cross purposes because they exist at opposite ends of the market. The differences are so fundamental that they are practically separate asset classes.

It is in these differences that the future of venture capital lies: the value unlocked by embracing the divergent strengths of early and late stage managers — with the former selling significant stakes from their portfolio to the latter.

This could represent a major positive development for venture capital, for a number of good reasons:

- Shortening liquidity horizons to ~6 years1

- Reduce the dilution required in a startup’s lifetime.

- Shortening the feedback horizons for LPs who cannot rely on incremental metrics like TVPI/IRR

- Better optimised for a firm’s specialisation on go-to-market or growth problems

- Reducing the risk exposure associated with downstream capital and later stage competitive pressure

- Limiting capital waste by introducing sell/buy tension at an earlier point in the startup’s life cycle, encouraging more rational pricing

- Preventing momentum investing from large funds distorting investment selection at early stages

In practice, this results in a division of the venture asset class into two main categories. While there will inevitably be some overlap in the middle, and some exceptions, it seems worth separating the two disciplines and their specific attributes:

Early VC: Pre-Seed – Series B/C

Smaller, thesis-driven firms that are focused on finding outliers. Founder friendly, research heavy, experimental, eccentric. Carrying a relatively smaller burden in terms of dilligence and transparency.

- Fund size: < $500M

- LPs: Accredited Investors/HNWs/FOs/Smaller Institutions

- Liquidity: Primarily secondaries

Late VC: Series B/C – Exit

Larger, metrics-driven firms that source strong performers directly from the early stage firms. Looking at proven businesses with high growth potential through a more standardised lens. Transparent about both deployments and LPs.

- Fund size: > $500M

- LPs: MFOs/Larger Institutions/Sovereign Funds

- Liquidity: IPO, PE secondaries, M&A

This bifurcation has two important additonal benefits:

- It shortens the feedback window for VC performance, and disincentivises pouring capital into hot deals for inflated TVPI.

- It provides clear deliniation for introducing major institutional capital and the enhanced regualtory scrutiny that should imply.

These two points reflect the goals of creating a more favourable environment for LPs, a more robust fundraising ecosystem that is less prone to bubbles and crashes, and an approach to enhancing transaprency without hampering the smaller early stage firms.

There are three hanging questions about the economics of this change:

- Whether the basic 2/20 fee structure ought to change in this scenario, and whether it should be significantly different between the two?

- The degree to which a rational market will change venture capital returns. How much have expectations been warped by the history of dumping overheated companies at IPO? Can we expect a more stable growth in value through the life of a company?

- What is different for firms like Lightspeed which may be using a continuation fund to buy their own secondaries?

In both of these cases, I think the solution is to let the market experiment and work this out — especially with added transparency and scrutiny on practices — I have more faith in positive outcomes. Even for Lightspeed, the performance of both units will be under seperate scrutiny, so the incentives should still work.

Why now?

What has changed in the last two years which makes this proposition attractive? Well, the IPO window closed. The strategy (as discussed in my previous article) of dumping companies with inflated valuations on public market investors came to an end.

An underestimated effect of that strategy, which dominated VC for the previous decade or so, was that it meant a disproportionate amount of value was unlocked at IPO — and VCs didn’t necessarily believe in the value of companies on the way there.2

Consequently, nobody wanted to offload their shares in a winning company until it went public. That’s when the big payout was. Clearly LPs liked the outsized returns for as long as they lasted, but now that era is over we are firmly back to looking at the timeline on returns.

In a market with a more rational perspective on value and pricing, you can make sense of a transaction at any point. Secondaries become much more appealing. Again, this is all covered in more detail in the previous article.

Certainly we appear to be at a point in history where every stakeholder in venture, from founders to LPs, should be interested in finding a better way forward.

This is just one proposal for what that might look like.

- Maybe longer in today’s market, but I expect that to contract again [↩]

- This is where the frankly obnoxious view of valuation as an arbitrary milestone comes from. [↩]