Creative ways to hide financial engineering

A rough example of the logic driving investment decisions amongst the most degenerate venture investors:

- You’re evaluating a company with $7.5M ARR

- $5M is net new ARR, annual burn is $10M

- That’s a 2x burn multiple (BM)

- You invest $30M at a market-rate of 20x ARR

- Assuming 2x BM, $30M produces $15M in net new ARR

- At 20x ARR, it gets marked up from $150M to $450M

On paper, that checks all the boxes: an investment that was subsequently marked up 3x using logic that could be decoded on an iPhone calculator.

Indeed, the role of multiples is to produce calculations that are easier and faster; to get deals done and put capital to work.

There are two major flaws with this approach:

The first is that multiples are backwards-looking. By applying to current revenue or burn, they rely on past performance. All assumptions about the future are squashed down into the multiple itself. Venture capital relies on making good judgements about the future, not the past.

The second is that multiples assume that all revenue is created equal. They ignore unit economics and capital expenditure, and nor do they fully appreciate churn. Finally, and particularly relevant today, they encourage founders to engage in creative accounting to boost ARR.

“We’ve actually come back to saying there’s a real advantage to seeng the GAAP revenue accounting, to make sure all the money is showing up for real.

There’s a lot of noise in that multiple, and when they were all SaaS recurring revenue businesses — all seat based, all 90% or 80% gross margin with no CapEx, all enterprise sales with low churn — it absolutely made sense. You could compare two companies. Thats’s why by 2019 or 2020 it almost felt like ‘fill in the form to give me the valuation’.

None of those conditions are true now.”

Rory O’Driscoll, Partner at Scale Venture Partners

Consider, for example, the venture capitalist’s typical disdain for discounted cash flow (DCF) style thinking in valuation: There are too many assumptions, the future is too uncertain.

So, instead, they price with ARR multiples, which include all of the same assumptions about the future, but obfuscates them into simple calculation. Out of sight, out of mind.

“Some investors swear off the DCF model because of its myriad assumptions. Yet they readily embrace an approach that packs all of those same assumptions, without any transparency, into a single number: the multiple. Multiples are not valuation; they represent shorthand for the valuation process. Like most forms of shorthand, multiples come with blind spots and biases that few investors take the time and care to understand.”

Michael Mauboussin, Head of Consilient Research at Morgan Stanley

Indeed, multiples are a popular tool precisely because they hide all of that detail. Remember, venture capital is (unfortunately) a game of building confidence with simple stories, not demonstrating competence with complex truths.

Financial engineering built on multiples is the bedrock of venture capital’s creeping financialisation.

Imagine you invest $20 in a company that generates $4 in ARR from each customer, with a CAC of $20. It trades at a multiple of 20x ARR.

- In practice, that company is losing $16 on every customer in the first year, with payback over 5 years assuming no churn.

- On paper, every $1 into the company produces $4 in marked value for the investor. It’s a great looking investment.

This is precisely the mechanic which incentivises insane capital consumption on negative unit economics. Investors trade financial health for faster markups, knowing that it’s a bust if the environment shifts.

“Guess what happened once Founders realized that VCs were valuing startups using revenue multiples? They started playing a game of Hungy Hungry Hippo with the goal of accumulating as much revenue as they could!”

Frank Rotman, Co-founder of QEDInvestors

“When market turns, M&A mostly stops. Nobody will want to buy your cash-incinerating startup. There will be no Plan B. VAPORIZE.”

Marc Andreessen, Co-founder of Andreessen Horowitz

To quickly round-out a few points, lazy thinking with multiples…

- …biases venture capital towards business that generate revenue quickly, which led to the neglect of deep tech.

- …promotes pushing companies to scale as quickly as possible, which produces worse outcomes for everyone.

- …contributes to VCs losing the ability to build independent conviction, encouraging herd-behavior.

In conclusion, multiples are a tool for quick comparison across peers. Not for pricing, and not for understanding performance or potential of a startup. They include far too many important and unchecked assumptions, limiting an investor’s understanding of the specific future of a company.

Proper valuation, with multiples used as a sanity-check afterwards, is the way.

“We often pursue this kind of rationalization as a spot check, generally after going through the valuation process. When the multiple is implied, investors will then compare it to others seen in the public and private markets to get more comfortable. Think of it like a gut check, a way to determine if the valuation feels ‘reasonable’.”

Alex Immerman, Partner at Andreessen Horowitz, and David George, GP at Andreessen Horowitz

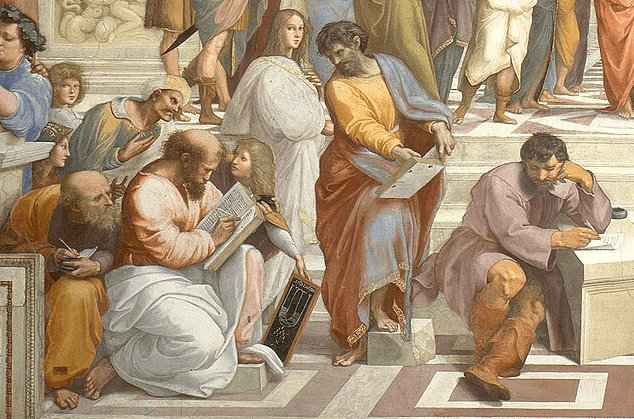

(top image: “The School of Athens“, by Raphael)

Leave a Reply