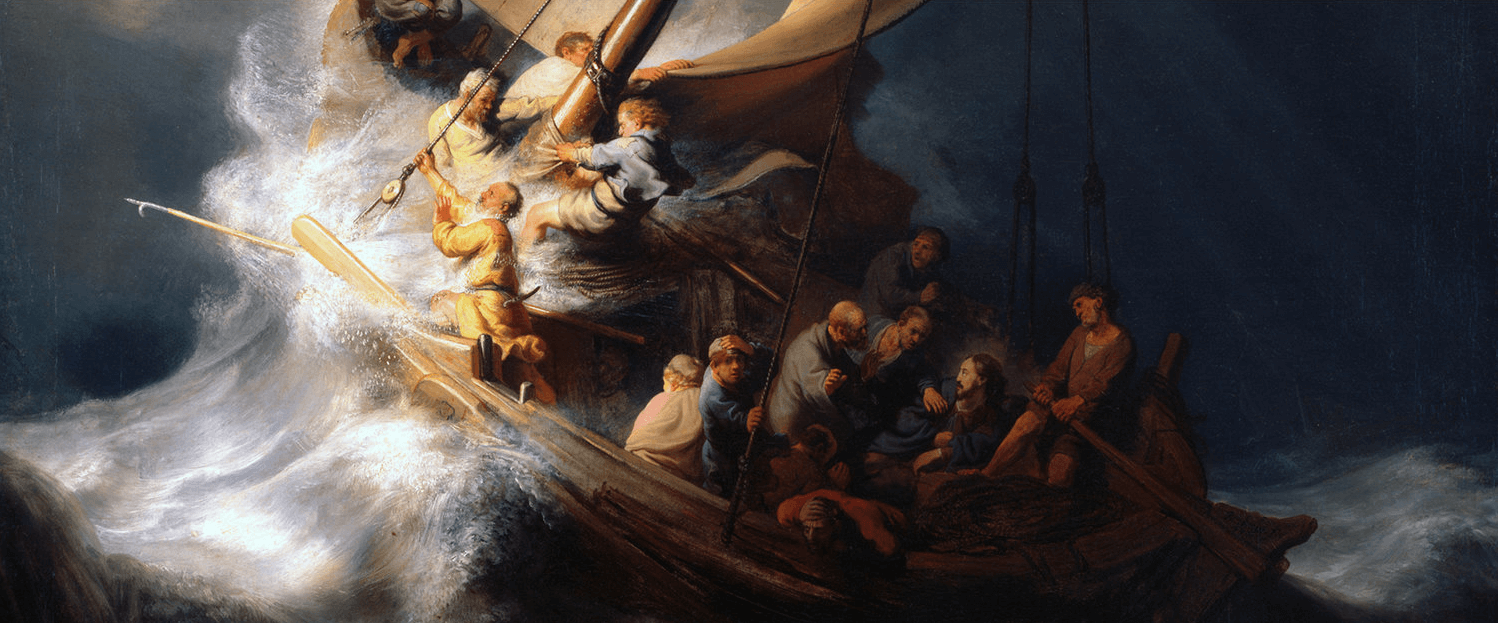

The history of human progress is predicated on the history of efficient risk capital formation. WIll Manidis The story of venture capital (and its precursors) is a story of risk. You can take this back as far as you like, from ARDC to Christopher Columbus. From whaling expeditions to space exploration. Risk is the product.… Continue reading Risk Capital

Tag: Valuation

Venture Capital’s ‘Knowledge Work’ Problem

While GenAI can improve worker efficiency, it can inhibit critical engagement with work and can potentially lead to long-term overreliance on the tool and diminished skill for independent problem-solving. Higher confidence in GenAI’s ability to perform a task is related to less critical thinking effort. source: The Impact of Generative AI on Critical Thinking This… Continue reading Venture Capital’s ‘Knowledge Work’ Problem

The Rot of Short-Termism in VC

Venture capital is a seriously long-term game, with investments taking somewhere between 8 and 16 years to return liquidity. The distance to that horizon creates a lot of eccentricity. For example, VC does not reward following patterns or navigating market movements, neither of which is relevant to decade-long cycles. Consensus of pretty much any kind… Continue reading The Rot of Short-Termism in VC

Adverse selection and venture capital

There’s a weird phenomenon among VCs where the less successful they are, the more evil they become to founders to squeeze more money out of their best startups out of necessity which then becomes a vicious cycle of adverse selection. Garry Tan, President & CEO of Y Combinator Including the above, criticism of venture capital… Continue reading Adverse selection and venture capital

“Why don’t VCs set marks with 409a valautions?”

This is a question I saw on Reddit’s often-comical /r/venturecapital, which I thought was interesting enough to write out a decent response to. It hits at the root of a few major problems in the asset class which are always worth addressing. A 409A valuation, named after Section 409A of the United States Internal Revenue… Continue reading “Why don’t VCs set marks with 409a valautions?”

Screening Pitches

There are five straight-forward questions with which you can quickly evaluate a startup pitch, combining the strength of a proposition with its delivery. These questions bear some some resemblance to the Scorecard Method of startup valuation, which focuses on qualitative measures for early-stage companies, but with an additional focus on quantifying the market need. I… Continue reading Screening Pitches