In a previous article I wrote about the threat of consensus in venture capital.

A few days later, Eric Tarczynski shared a fascinating thread about the journey with Contrary, his VC firm. He addressed this point about consensus with admirable candour, summarised here in two points:

- Raising from LPs is easier if you have recognisable logos attached to your previous funds. Success is measured by which big names in VC co-invested with you.

- Raising from LPs is easier if they get good references from their existing VCs. So you send deals to them, network with them, and co-invest with them. Success is measured by relationships.

It’s unusual to get such an unvarnished look at the inside workings of venture capital, and the thread elicited a number of reactions. Most agreed it was a tough pill to swallow:

Eric’s awesome but boy is that thread a pretty damning look into the inside-baseball-nepotism that starts from the top (LPs) and infects the whole VC ecosystem.

Luke Thomspon [source]

‘We thought that being good investors with a unique thesis that actually makes money would be the best strategy, turns out, following the herd, piling onto garbage, and being unquestioning vassals to incumbent investor power gets you a larger fund’ – My interpretation

Del Johnson [source]

There’s an elephant in the room in all of this. Or perhaps it’s a bull in a china shop. Either way, everyone seems to be ignoring it and it’s doing a lot of damage.

Weak signals

From pre-seed to IPO, there is no consistent, transparent measure of success. That’s a long time for a GP to deploy capital without any concrete metrics for success. How does an LP ascertain if their money is being put to good use?

Samir Kaji of Allocate (and former SVB MD) shared his take on the problem that LPs face:

LPs are programmed to use past track record as the primary driver in making a decision on whether to invest in a new fund (A recent study showed historical persistence of VC is that 70% chance a fund performs above median if prior fund is 1st Q). However, more than ever, track record can be a very weak indicator if the fund is within <5-7 years.

- Spread of how VCs are valuing the same companies is large.

Samir Kaji, Allocate

- Current TVPI to final DPI delta will be large for many funds, and some funds have resilient companies; others are filled w/companies that were pure momentum (but still marked up).

There is an obvious desire from both sides to find something to show. As Luke put it, “we can pretend it’s all about independent thinking, non consensus and right, etc, but when you’re going out for Fund 2 and on a stack of unrealized, LPs want other signals.”

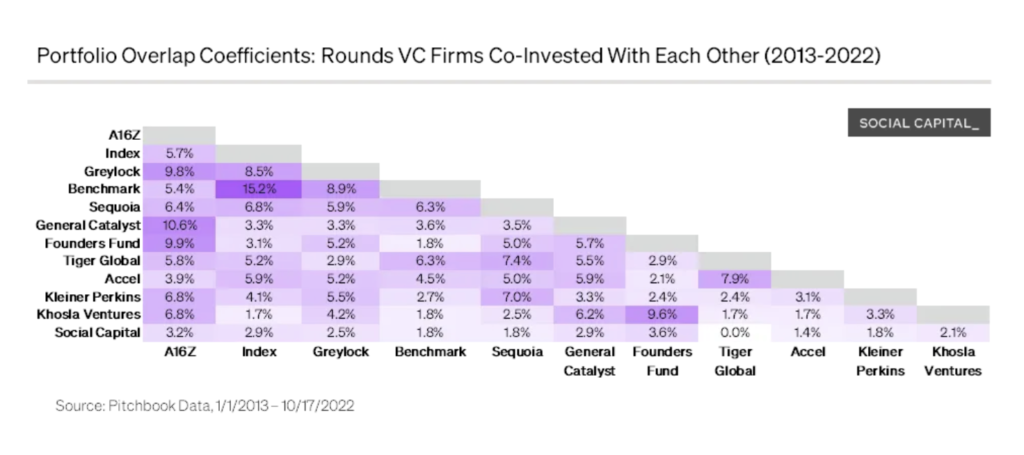

This is why we end up focusing on ‘logo hunting’ and co-investment culture. If we’re all a gang, and we back each other up, then we’ll maintain the confidence of LPs. Meanwhile, the LPs are probably feeling a degree of comfort from investing in a few different funds, without realizing how intermingled and codependent they are.

As Chamath Palihapitiya wrote in Advice to Startup Founders and Employees: Strength Doesn’t Always Come in Numbers:

As it turns out, what VCs of the past decade assumed to be market alpha may have actually been market beta (i.e. fellow venture funds bidding up the same cohort of companies over several funding rounds).

Chamath Palihapitiya, Social Capital

This is clearly an undesirable outcome for LPs: The data for measuring venture capital fund performance is flimsy and creates a huge perverse incentives for GPs. This is clearly not good enough when so much capital is at stake. Especially when it involves pensions funds and university endowments. It’s a bad look for everyone.

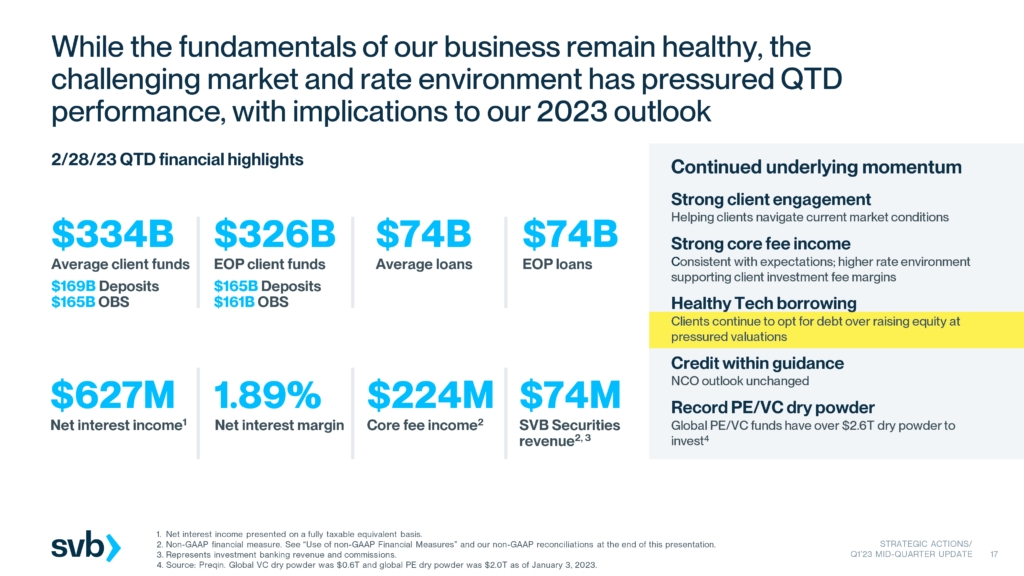

The final nail in the coffin here is how current practices can create a reality-distortion field around actual performance: in effect, a company’s ‘public’ valuation only changes when they want it to. This was outlined at length in a thread from Anand Sanwal of CBInsights, which included this slide from SVB:

This is on the mind of every LP at the moment. What do their ‘paper’ returns from 2021/22 actually mean anymore? What will happen when the companies they are invested in via VC are forced to come to terms with reality?

Meaningful benchmarks

When you start talking about standardising anything in venture capital, there’s a reliably cold response. Everybody likes to believe they have their secret sauce, their intuition, their process, their edge over others… despite all signs pointing towards none of that changing the outcome.

When you talk about measuring the performance of early stage companies, that’s when the real pushback begins. There’s too much uncertainty. It’s too unreliable. Projections are always a pipe-dream.

There’s one simple response to these concerns: “Perfect is the enemy of good“.

If you open yourself to new ways of looking at valuation (it’s not just about “market passing”), and new ways of performing valuation, you will find that there are practical, systematic frameworks to measure and report the development of private companies.

Don’t get twisted up about producing an “accurate” result for an early stage company, it is foolishness – and not the point. The goal is to provide solid, useful benchmarks which can be calibrated against the market in a transparent manner.

For an example of how this might be achieved, I will always recommend a read through Equidam’s methodology. It combines perspectives on verifiable characteristics via the qualitative methods, the exit potential via the VC method, and the vision for growth via the DCF methods. All packaged up into a nice, comprehensive report.

What standardized reporting does for the LP/VC relationship

If you can imagine a world where VCs produce quarterly reports on fund performance using a standardised framework, there are a number of profound benefits:

- LPs could better assess the performance of their existing VCs, creating more of a meritocracy.

- VCs would have an easier time raising, in addition to shortening their own internal feedback-loops to improve decision making.

- Moving away from current lazy valuation practices (ARR multiples) would help avoid extreme fluctuations in valuation, as we’ve experienced since 2021.

- It will (slowly) kill the dinosaurs, the giant firms which played a part in the development of this ecosystem and all of its flaws.

- A move towards transparency – especially around valuation – would be timely, as the SEC’s gaze falls on venture capital.

- There are also interesting considerations for liquidity in secondary markets serving private company equity, but that’s a whole post of its own.

Conclusion

It seems clear to me that this change will not come easily to venture capitalists, who are either comfortable with the status-quo or simply find it convenient. However, it might be possible for LPs to set new terms as market dynamics have shifted power in their direction.

Still, this is a difficult argument to make. I’m suggesting no less than upending how much of venture capital operates, and I’m doing so from the position of a relative outsider.

But I guess that’s the point? Venture capital has been a closed ecosystem for too long, full of esoteric practices shaped by a relatively tiny group of individuals. There is plenty of room for improvement, especially if we stop getting hung up on the need for ‘perfect’, when the current status is ‘poor’.

Finally, a bigger point than any of the six I mentioned previously: if this makes us better at allocating capital to innovative ideas, and innovative people, then it’s got to be worthwhile.

3 comments